Overview

Economic Resilience in the GCC

- The Gulf Cooperation Council (GCC) countries continue to exhibit strong economic resilience, adeptly navigating through global market volatility. This resilience is attributed to strategic fiscal policies, innovative diversification efforts away from oil-dependency, and robust financial regulations ensuring stability across the region.

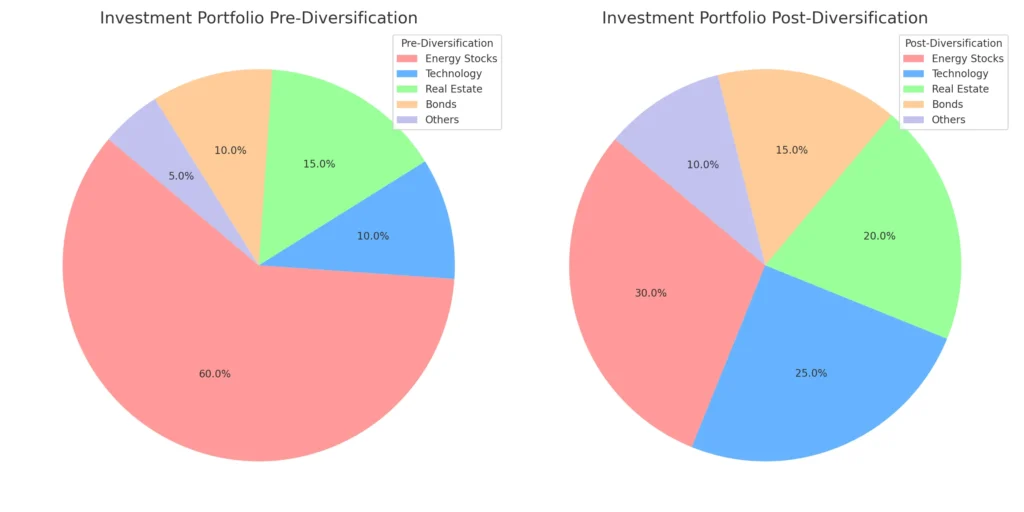

Strategic Shifts and Diversification

- A pivotal trend is the region’s move towards diversifying its economic base. By broadening investment into non-oil sectors such as technology, healthcare, and renewable energy, Middle East funds are mitigating risks and seeking sustainable growth. This diversification is supported by governmental initiatives and regulatory reforms, fostering a conducive environment for foreign investment and private sector participation.

Technological Innovation in Wealth Management

- The digitization of financial services and the integration of fintech innovations are transforming wealth management. Personalized investment solutions, enhanced by artificial intelligence and blockchain technology, are improving the efficiency of transactions, reducing costs, and increasing transparency, thereby attracting a new generation of investors.

The Ascendancy of ESG Investments

- Environmental, Social, and Governance (ESG) criteria are increasingly becoming central to investment strategies within the Middle East. Driven by global sustainability trends and regional commitments to the Paris Agreement, investors are prioritizing ESG-compliant projects, leading to a reevaluation of asset allocations in favor of green and sustainable ventures.

Regulatory Evolution and Sustainability Focus

- Recent years have seen significant regulatory changes aimed at creating a more resilient and sustainable financial ecosystem. These changes include enhanced corporate governance, increased transparency, and the introduction of sustainable finance frameworks, which collectively underpin the region’s ambition to be at the forefront of ethical investing.

Follow us:

Follow us on LinkedIn, Facebook, YouTube, or Spotify for our latest podcasts, whitepapers, blogs, job postings, and career advice. Stay updated on valuable insights and resources to enhance your leadership journey and shape the future of your career. Join our community and embark on a transformative path towards effective leadership and professional growth.