Circular Business Model Examples: Sustainable Innovation

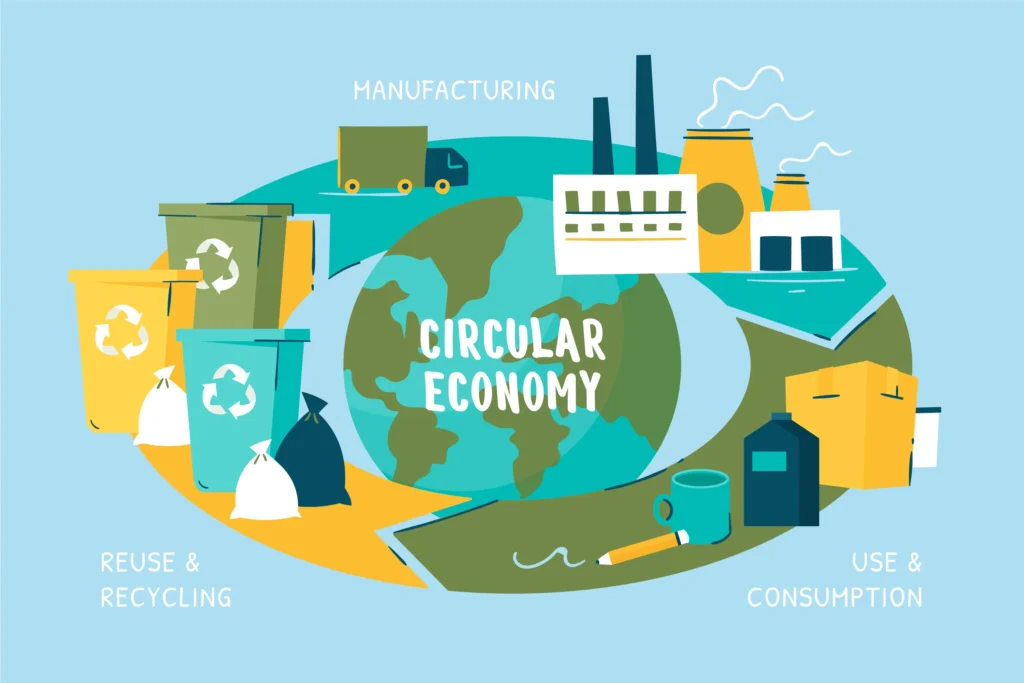

The paradigm shift towards sustainability has turned the spotlight on circular business model examples that epitomize sustainable innovation. These trailblazing companies are redefining the essence of business, intertwining economic viability with environmental stewardship. By strategically adopting circular principles, they are not only reducing waste and environmental impact but also unveiling new growth avenues and competitive […]

Asset Allocation and Security Selection Explained

In this article, we will explore the concept of asset allocation and security selection and how they play a crucial role in shaping your investment strategy. Understanding these concepts is essential for investors to manage risk effectively, achieve their financial goals, and optimize their investment portfolios. We will delve into the importance of asset allocation, […]

Air Freight vs Sea Freight Carbon Footprint Analysis

As the world grapples with climate change, businesses and consumers are increasingly focusing on the sustainability of their supply chains. Amongst the critical decisions they face is the choice between air freight and sea freight, two dominant forms of transporting goods worldwide. This choice is not only about speed and cost but also concerns the […]

Going Concern Value: Business Valuation Essentials

Welcome to our comprehensive guide on going concern value and its crucial role in business valuation. In this article, we will explore the key factors that contribute to determining a business’s going concern value, highlighting its importance in evaluating a company’s real worth and future potential. When assessing the value of a company, it’s essential […]

Expert Insight on Corporate Finance And Restructuring

In today’s ever-changing business landscape, companies face numerous challenges in navigating the complexities of corporate finance and restructuring. Whether it’s adapting to evolving market conditions, addressing financial distress, or seeking opportunities for growth, organizations need expert guidance to optimize their performance and achieve their strategic goals. In this article, we will explore the fundamentals of […]

Equity Research in Investment Banking Explained

Equity research plays a crucial role in the world of investment banking, bringing together the worlds of finance and analysis. This essential function impacts capital markets and shapes investment strategies, making it a vital component of successful investment decisions. Equity research analysts diligently analyze financial data, industry trends, and market conditions to provide valuable insights […]

Understanding Traditional Risk Management Basics

In the realm of business strategy, the concept of traditional risk management is foundational in helping organizations manage risks. Historically, traditional methods have honed in on insurable risks—such as natural disasters, theft, or legal liabilities—with a keen eye on the proverbial bottom line. One distinguishes traditional risk management environments by their systematic and compartmentalized risk […]

Blockchain in Investment Banking: Key Impacts and Use Cases

Welcome to our article on blockchain in investment banking. In this section, we will explore the potential of blockchain technology and its key impacts in the financial services industry, specifically in the banking sector. Blockchain technology has emerged as a groundbreaking innovation that has the power to revolutionize traditional banking practices. Its decentralized nature and […]

Fintech Emerging Markets: Growth & Innovation

Fintech is rapidly gaining ground in emerging markets, bringing innovation and addressing the needs of underserved populations. As these economies develop and embrace technological advancements, the fintech industry is flourishing, presenting new opportunities for growth and disruption. In this article, we will explore the potential for fintech in emerging markets, the adoption of innovative technologies, […]

Unlocking Efficiency with Blockchain Asset Management

In today’s rapidly evolving asset management industry, efficiency, security, and transparency are crucial factors for success. Enter blockchain asset management – a revolutionary technology that has the potential to transform the way assets are managed and traded. Blockchain asset management utilizes the power of decentralized ledgers and smart contracts to streamline processes and eliminate intermediaries. […]